Archive for the ‘ICE’ Category

Monday, August 20th, 2012

By: Timothy Sutton, Communications Editor

The State of Arizona behind Governor Jan Brewer has made their position clear, they do not support Deferred Action Childhood Arrivals. Brewer signed her own executive order to “defend” Arizona from President Obama’s Deferred Action Program. Executive Order 2012-06 alleges that because DACA workers are not given lawful status, but merely deferred status, DACA recipients can be legally denied the right to obtain a driver’s license or any public benefit.

Brewer justifies her executive order as a defense against DACA which she refers to as “federal paperwork,” that will result in “significant and lasting impacts on the Arizona budget, it’s healthcare system and additional public benefits that Arizona taxpayers fund.” A Brewer spokesperson sited specific public benefits that DACA holders will not be eligible for: KidsCare, a children’s health-insurance program; unemployment benefits; business and professional licenses and government contracts.

Legal challenges to Brewer opposition of Obama’s DACA program are expected this week. Under the REAL ID Act of 2005 Sec.202(C)(B)(2)(viii), a federal law that modified requirements for state driver’s licenses and ID cards, “deferred action” is a term used for those eligible for state issued identification and driver’s licenses. According to NBC News, Regina Jefferies a local Phoenix attorney, criticized Brewer’s executive order saying, “Immigrants in Arizona have in the past been granted “deferred action” for other reasons long before the new Childhood Arrivals program was announced.” Additionally, Brewer’s spokesperson said that DACA students would not receive in-state tuition pricing.

After Brewer’s announcement, protester’s outside of the Arizona state capital waived signs that read, “Why the hate?” This sentiment raises the question, is Brewer guilty of playing politics with immigrant lives? Certainly, extreme curtailing of the DACA program by states like Arizona (and Florida) appears to be less about state preservation than politics. This preemptive strike against the Presidential Executive Order is a sign of the strong resistance to come for future immigration reform that favors inclusion over deportation.

California officials announced they would honor the DACA program and issue driver’s licenses to eligible persons. As temporary California residents, DACA beneficiaries will be afforded in-state tuition pricing, driver’s licenses, and the temporary ability to seek employment.

The national success of the DACA program shall remain closely monitored. We will continue to keep you updated on this and other breaking immigration news. If your business has questions about the DACA program or hiring from this temporary workforce, contact one of our immigration professionals at info@immigrationcompliancegroup.com or call 562 612.3996.

Please check out our news and stay informed.

More articles: AZ Denies Dreamers GED Classes

Driver’s Licenses Vary by State

Tags: Arizona Immigration, AZ Gov. Jan Brewer, Comprehensive Immigraiton Reform, DACA Program, Deferred Action for Childhood Arrivals, Dreamers, illegal immigrants, Immigration Reform, Legal Workforce, President Obama Executive Order, Undocumented Workers

Posted in DACA | DAPA, Employer Compliance, ICE, Immigration Legislation, Immigration News | Comments Off on Brewer v. Obama: AZ Won’t Issue Driver’s License To DACA Workers

Thursday, August 16th, 2012

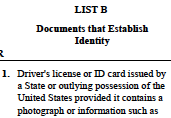

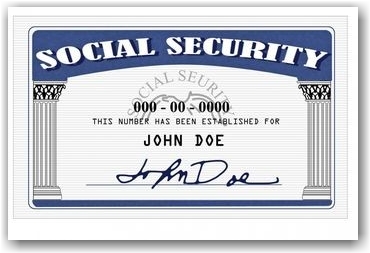

The Department of Justice Office of Public Affairs recently published a press release pertaining to the employment of two refugees resolving allegations that the company discriminated under the anti-discrimination provision of the Immigration and Nationality Act (INA), when it impermissibly delayed the start date of two refugees after requiring them to provide specific Form I-9 documentation. Best Packing’s violations occurred when they required the refugees to supply the company with additional Form I-9 verification documents in excess of the law. The claim alleged that other non-refugee employees were not required to supply documents other than state issued licenses and social security cards.

In two charges filed with the department, the refugees alleged that they were not allowed to begin employment until they produced unexpired, Department of Homeland Security-issued employment authorization documents, despite the fact that they initially presented sufficient documentation for employment eligibility verification purposes. The charging parties had presented unexpired state identification cards and unrestricted Social Security cards. The state ID’s and unrestricted SS cards were deemed insufficient proof of work authorization.

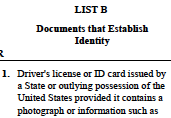

It is necessary for all those charged with Form I-9 processing at your organization to be very familiar with the list of acceptable documents and to have a thorough understanding of the fact that each employee has the right to present a list A document or a combination B plus C document as long as they are acceptable documents, appear to be genuine and represent the employee that is before you.

Under the settlement agreement, Best Packing agreed to pay $4,379 in back pay and comply with all the requirements of the INA. Understanding the Form I-9 requirements for verifying refugee/asylee(s) will prevent your company from falling victim to similar discriminatory hiring practices.

The process by which an employer is required to verify the employment eligibility of a refugee/asylee(s) when presented with documentation other than the above-referenced List B plus List C combination, can be a bit complicated. Let’s review this.

Asylees and Refugees are individuals seeking the protection of the United States due to persecution suffered in the home country based upon: race, religion, nationality, social group, or political ideology. These individuals are authorized to work in the US because of their immigration status. When presented with documentation of asylum or refugee status, it is advisable to be aware of the following in regard to examining the I-9 form and the documents presented:

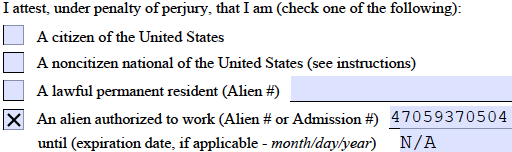

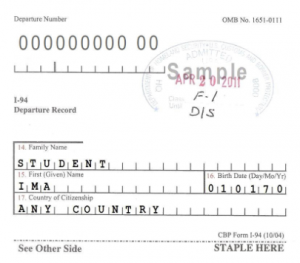

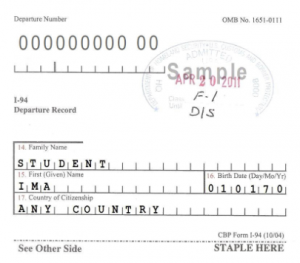

SECTION 1:

- The employee should check the “An alien authorized to work” box

- Write the I-94 or Alien Registration Number in the first space

- Write “N/A” in the second space, because their employment authorization does not expire

SECTION 2:

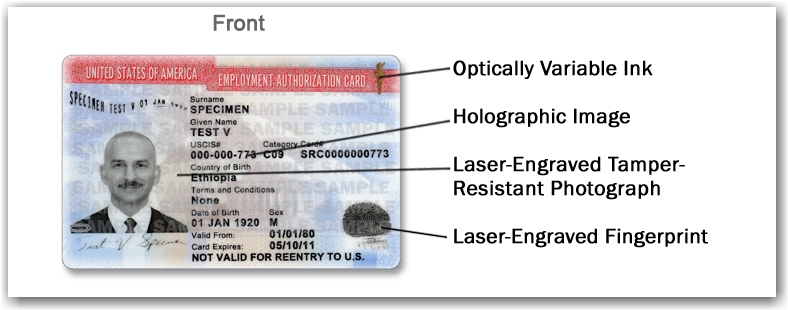

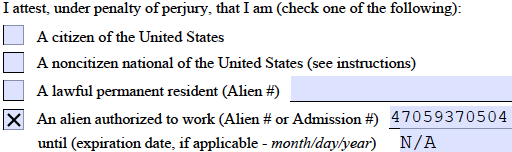

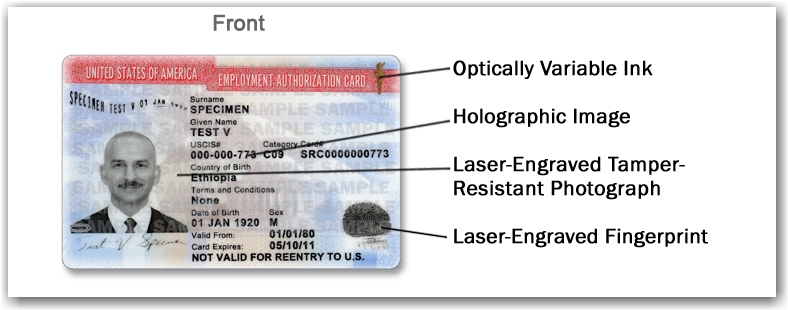

Acceptable Documents are I-94, I-766, or their Employment Authorization Document also known as an EAD card

NOTE: this section presents two different scenarios that require strict attention to time restrictions and combinations of required documents to be presented in order to comply with the USCIS regulations. To complete this section choose from the applicable scenarios below:

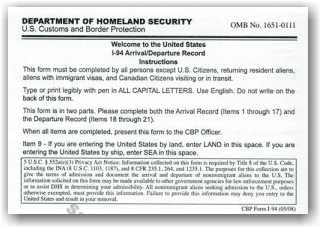

Scenario One: Refugee presents a Form I-94:

When presented with a Form I-94 containing an unexpired refugee admission stamp, the employer must accept it as a receipt establishing both employment authorization and identity for 90 days. After 90-days, the employee must present either an EAD or a combination of a List B document and List C (an unrestricted social security card.)

Scenario Two: Asylee presents a Form I-94:

An employer must accept Form I-94 or Form I-94A with one of the stamps or notations below indicating asylee status:

- Asylum granted indefinitely

- 8 CFR 274a.12(a)(5)

- INA 208

This is a List C document that does not require/contain an expiration date. However, the asylee will need to present a List B identity document with this Form I-94.

*Decisions from immigration judges granting asylum are not acceptable.

For further assistance on training your company’s hiring personnel on all of the requirements of Form I-9 compliance, contact one of our immigration professionals at info@immigrationcompliancegroup.com or call 562 612.3996.

Tags: Best Packaging I-9 Ruling, DOJ, I-9 Acceptable Documents, I-9 Anti-Discrimination Provision, I-9 Discrimination, I-9 Document Examination, I-9 for Refugees/Asylees, I-9 Over-Documentation, I-9 Training, I-9/E-Verify News, ICE, OSC, Worksite Enforcement

Posted in Employer Compliance, I-9/E-Verify News, ICE, Immigration News, Uncategorized, USCIS | Comments Off on Form I-9 How To Guide: Employing Refugee/Asylee(s)

Tuesday, August 14th, 2012

By: Timothy Sutton, Communications Editor

The biggest names in banking, Goldman Sachs, JP Morgan, Wells Fargo, Bank of America, Lehman Brothers, MF Global, Countrywide, and Chase have been subject to financial misconduct investigations for imprudently squandering hundreds of millions of dollars. Last week the Justice Department made the unfortunate announcement that Goldman Sachs would not be charged for its infamous trades. Yet over the past few years, despite the devastating impact hedging bad debt has done to our economy, virtually no criminal or civil penalties have ensued. Economists and legal analysts have a range of theories attempting to explain how crimes of “greed” go virtually unpunished; one plausible explanation is we are all to blame: investors, bankers, consumers, government and regulators all contribute to the degradation of our banking system. The SEC has become somewhat of a paper tiger launching costly and intricate investigations resulting in piles of reports that ultimately assign no guilt.

Conversely, ICE investigations almost invariably result in hefty civil and even criminal fines. Deportation raids and I-9 audits are typically swift and allow few of the procedural processes that SEC, Department of Treasury, or Department of Labor investigations require. Over the past few years, there have been record numbers in both deportations and employer sanctions issued by ICE and the USCIS. Unlike greed, failure to maintain a lawful workforce endures the cold chill of ICE.

Shockingly, the public reaction to the financial crisis has been fractured and highly politicized. Remember the Tea Party and Occupy movements? Alternatively, punishing companies employing immigrant workers has found a stronghold in national politics. While it is unjustifiable to violate any law of the United States, it is alarming that those who protest against the corruption of financial institutions are considered extremists, but those who protest against hiring immigrants are nationalists? It is possible that the simpler the crime the harsher the time explains this phenomenon. Americans don’t understand how billions of dollars could disappear from the banks they entrusted their life-savings to; but can easily conceptualize how an immigrant workforce may under-cut “American” employment.

As business owners, violating simple duties like Form I-9 compliance and employment verification through E-Verify may result in the most damaging penalties. There are no congressional investigations, lengthy judicial proceedings, or public sentiment to lessen the blow of an ICE audit. In light of our current social political environment it would be a prudent investment to seek the advice of immigration professionals to proactively prepare for an immigration audit. For more information contact one of our immigration professionals at info@immigrationcompliancegroup.com or call 562 612.3996.

Tags: Bank of America, Chase, Countrywide, Curency Hedging, Goldman Sachs, I-9/E-Verify News, ICE, ICE Audits, JP Morgan, Lehman Brothers, MF Global, Mortgage-Backed Securities, Too Big to Fail, Wall Street Firms, Wall Street Meltdown, Wells Fargo

Posted in DOJ, Employer Compliance, I-9/E-Verify News, ICE, Immigration News | Comments Off on Enforcement Seesaw: Financial v. Immigration Violations | Immigration Compliance Group News

Sunday, August 12th, 2012

By: Timothy Sutton, Communications Editor

On August 10, 2012, the 3rd Circuit Court of Appeals ruled in favor of Wal-Mart Stores Inc., facing charges for acts of transporting illegal immigrants, harboring illegal immigrants, encouraging illegal immigration, conspiracy to commit money laundering, and involuntary servitude. Zavala et al. v. Wal-Mart Stores Inc., spanned eight years and four judicial opinions. The allegations against Wal-Mart suggested that senior officials knowingly and willingly permitted contractors and sub-contractor to hire illegal immigrants to perform after-hour janitorial services.

In their defense, Wal-Mart asserted that the plaintiff janitorial workers were not employees (therefore, not under their control), but also performed work at a Marriott hotel, a movie theater, and remodeling homes. Further, Wal–Mart often used store associates (regular, non-contract employees) to clean its stores. As a result, the court found that Wal-Mart did not knowingly hire illegal immigrant workers or encourage their contractors to do so. The court refused to certifying the class action based upon the shared discrete characteristic of plaintiffs as undocumented immigrants, stating: “Being similarly situated does not mean simply sharing a common status, like being an illegal immigrant.”

Moving forward, it is likely that Wal-Mart will amend its screening and compliance policies when hiring contractual workers. Many of the allegations against the big-box retailer reveal suspect employment practices that should be avoided including:

- Management commenting on immigration status of workers

- Using out-of-state relief workers immediately following the arrest of workers by federal immigration authorities

- Allowing workers to store personal belongings in store

- Allowing workers to sleep in store

For more information about the latest immigration court rulings and other breaking immigration news, subscribe to our blog and contact our office to discuss your I-9 audits, training and compliance program needs, 562 612.3996, info@immigrationcompliancegroup.com.

Tags: Employer Compliance I-9/E-Verify, ICE, illegal immigrants, Legal Workforce, Undocumented Workers, Walmart Janitor Contractors, Walmart Janitorial Class Action

Posted in Employer Compliance, I-9/E-Verify News, ICE, Immigration News | Comments Off on Squeaky Clean? Wal-Mart Escapes Janitorial Class Action | Immigration Compliance Group News

Friday, August 3rd, 2012

By: Timothy Sutton, Communications Editor

By: Timothy Sutton, Communications Editor

Shortly after ICE began their Form I-9 audit of the San Antonio based sushi chain, Sushi Zushi, an exodus of employees forced the company into a weeklong-statewide shutdown. After an internal announcement by Sushi Zushi management to employees of the routine audit, a wave of scared employees did not return to their jobs on Friday Morning. A public statement was issued by Sushi Zushi’s public relations spokesperson; Judy McCarter detailing the company’s decision:

STATEMENT FROM SUSHI ZUSHI, Friday, July 27, 2012

Sushi Zushi has temporarily suspended its operations and closed its restaurants in San Antonio, Austin and the DFW Metroplex. We plan to resume operations as soon as possible.

The decision to close the restaurants was made at Sushi Zushi today by executive management due to an unanticipated internal reaction to news of a routine I-9 audit. Several vital employees have chosen not to report to work. This has affected our ability to provide our expected level of service to guests. CEO Alfonso Tomita is returning from travels outside the country.

Sushi Zushi’s policy is to comply with all federal, state and local laws and regulations. And Sushi Zushi has made its best efforts to comply with I-9 requirements always done appropriate due diligence on all its staff. Sushi Zushi is working with legal counsel to respond to the government’s audit.

We wish to be clear – there was no raid by the government on our operations. Nor has any employee been detained by the government or terminated by the company. Sushi Zushi is responding to a routine I-9 audit. We apologize in advance for the inconvenience and appreciate the patience of our loyal guests while we work through this issue.

Company management immediately posted want ad’s on Craigslist and Facebook. Their customers posted their concerns across social media, including accusations of mismanagement that surfaced on reddit.com. In the midst of this audit meltdown, an employee announced via facebook that he was promoted from delivery driver to sushi chef. With the company’s reputation spinning out of control, their facebook page had posts of former kitchen employees who remarked, “The food won’t be the same without us,” while other employees joked with friends that they had a week-off work to “fill out their I-9 forms.”

Before ICE issues a dollar of fines or fees, Sushi Zushi will suffer hundreds of thousands in loses and devastating harm to their reputation. Sushi Zushi employees fled because they were not educated on the differences between an I-9 audit and deportation raids. Clearly, today’s ICE audits are shaping up to be equally as effective in deterring unlawful employment as raids of the past. To prevent your company from becoming the next Sushi Zushi, contact our immigration professionals for their expert knowledge on Form I-9 compliance, and sign up to receive our information and visit our Employer Resource Center: www.I-9Audits.com

Tags: I-9 AUDIT, I-9 Fines, I-9 management, I-9 Training, I-9/E-Verify News, ICE Audit, Legal Workforce, Sushi Zushi Audit, Undocumented Workers, Worksite Enforcement

Posted in I-9/E-Verify News, ICE, Immigration News, USCIS | Comments Off on Form I-9 Audit Prompts Sushi Zushi Closure – Fish on ICE

Sunday, July 29th, 2012

By: Timothy Sutton, Communications Editor

By: Timothy Sutton, Communications Editor

Wait Wait… Don’t Tell Me! is a comedic quiz program on NPR, testing listener’s knowledge of current events against some of the best and brightest in the news world. While figuring out what’s real news versus what’s made up, the show’s host presents a scenario to the contestant to determine if the scenario is fact or fiction. If you weren’t tuned into C-SPAN, you may have legitimately mistaken the House oversight committee’s interview, of the Secretary of the Department of Homeland Security (DHS) Janet Napolitano, as the latest episode of Wait Wait.

In this episode, members of the Congressional oversight committee rapidly fired questions at Napolitano, cutting short her responses, attempting to validate their “real news,” as something more than “made up.” The result, a trial like inquisition reminiscent of the famous scene between Tom Cruise and Jack Nicholson from A Few Good Men, with Napolitano ceremoniously remarking “you can’t handle the truth!” In reality, with grace and imperturbable resolve, Napolitano slowly roasted over the House Committee’s rotisserie.

Attacks upon the DHS Secretary by Chairman Lamar Smith (R-TX), Sensenbrenner (R-WI), Conyers (D-MI), and many more; indicated summary judgment has been rendered against the DHS for their approach to immigration enforcement, particularly in the areas of: visa overstays, boarder security, and deferred action. The business community should take note; Napolitano’s significant immigration reforms have yet to satisfy Congressional discontent. Looking forward, expect tighter regulation of business immigration under the guise of immigration overhaul.

Here are some DHS immigration reform highlights Napolitano submitted to Congress:

- Current DHS immigration reform focuses resources on repeat immigration law violators

- Numerous improvements were made to welcome business people…staying true to our history as a nation of immigrants

- Deterring Employment of Aliens not authorized to work by:

- Eliminating high-profile raids and focusing on compliance through criminal prosecution of egregious employer violators, Form I-9 inspections, civil fines, and debarment

- Since 2009, ICE audited more the 8,079 employers, debarred 726 companies, and imposed $87.9 million in financial sanctions

- Educated the business population through instituting:

- E-Verify with more than 385,000 participants

- E-Verify self-check

- Improving Legal Immigration:

- Streamlining path for EB-5 entrepreneurs and clarifying the EB-2 classification

- Instituted Entrepreneurs in Residence program and proposed regulatory changes in the Federal Register in April 2012 to minimize delays of family based immigration petitions

- Reduced processing of benefit requests through Electronic Immigration System of Registration (ELIS)

- Implemented “Study in the States” initiative to attract international students through a streamlined visa process

- Comprehensive Immigration Reform:

- Supporting the Supreme Court’s decision on Section 2(B) of S.B. 1070

Napolitano capped off her remarks on immigration stating, “only a nationwide solution will resolve the challenges posed by the current immigration system.”

Despite the Congress clearly conveying their message to DHS, “Wait wait, don’t tell me, you think you’re doing a good job…” Napolitano’s focus on streamlining existing immigration policies is positive news for US businesses. Until the promise of streamlining comes to fruition, removing your business from the auditing radar, enrolling in E-Verify, and becoming Form I-9 compliant remain immigration best practices.

If you can handle the truth about current immigration policies, subscribe to our blog and stay informed by checking out our I-9 Employer Resource Center and join our LinkedIn Group.

Tags: Comprehensive Immigration Reform, Deferred Action, Department Of Homeland Security (DHS), DHS Secretary Napolitano, E-Verify, E-Verify Self Check, EB-5 Investor Visa, Entrepreneurs in Residence, form I-9, I-9/E-Verify News, ICE, ICE investigations, Legal Workforce, Napolitano's Congressional Testimony, Study in the States, US Immigration Policy

Posted in Comprehensive Immigration Reform, Congress, Department Of Homeland Security (DHS), I-9/E-Verify News, ICE, Immigration Legislation, USCIS | Comments Off on DHS Secretary Roasted By Congressional Committee | Immigration Compliance Group News

Saturday, July 21st, 2012

By: Timothy Sutton, Communications Editor

Swiss based Nestle has discovered “numerous” violations of its internal work rules as a result of internal auditing aimed at combatting child labor. The manufacturer of Kit-Kat bars reported that four-fifths of its cocoa comes from unmonitored labor channels. The Fair Labor Association is insisting Nestle implement higher supply chain standards moving forward. The cocoa industry is fraught with child labor issues, with child worker rates reaching upwards of 89% in the Ivory Coast. Unfortunately this far-reaching problem will not be solved overnight, “The complexity of child labor in the cocoa supply chain means solving the problem will take years,” Nestle said.

As a result of Nestle’s voluntary audit, the company has avoided penalties thus far. However, their involvement in child labor comes at a price. The company is now committed to altering supply chain practices and will invest heavily in future monitoring services.

While most American businesses can rest assured they are not supporting the underground child-labor industry, Nestle’s efforts to self-assess and reform should be applauded. Domestic and international companies will benefit greatly from routine internal audits that track workforce compliance. USCIS and ICE encourage employers to frequently perform internal audits of their Form I-9 practices. In fact, records of regular auditing of your workforce may help you avoid hefty civil penalties in the event of an official government audit. The next time you “break off a piece of that Kit-Kat bar,” consider following Nestle’s example of self-auditing and contact one of our immigration professionals at info@immigrationcompliancegroup.com or call 562 612.3996.

Other resources:

Tags: Child Labor Laws, E-Verify, Fair Labor Association, I-9 Audits, I-9 Compliance, I-9 Training, I-9/E-Verify News, Legal Workforce, Nestle, Voluntary Audits, Worksite Enforcement

Posted in Department Of Homeland Security (DHS), I-9/E-Verify News, ICE, Immigration News | Comments Off on Nestle KID-Kat Bars?: Audit Helps Chocolate Maker “Grow Up”

Wednesday, July 18th, 2012

By: Timothy Sutton, Communications Editor

By: Timothy Sutton, Communications Editor

In an effort to assist participating employers comply with the user requirements of E-Verify and to help improve participants’ overall use of the program, USCIS issued two self-assessment guides in June. Both guides are substantively similar, but are procedurally designed to assist two sets of users, either web-access or direct access users. Voluntary E-Verify participants will benefit from this recent assistance publication by following the eight-part checklist provided therein.

The self-assessment checklist covers, post-enrollment activities, creation of cases, photo matching, tentative nonconfirmation, DHS referral, SSA referral, final case resolution, and final case closure statements. USCIS touts E-Verify as an easy-to-use online tool, but warns, “Employers may be subject to legal action for some types of E-Verify misuse.” The self-assessment guide highlights below may surprise current E-Verify users who may unwittingly be noncompliant:

Monitored Activities Common Mistakes:

- Duplicate cases for same employee

- Verifying employees hired before 11/7/86

- Immediately terminating employee who receive a tentative nonconfirmation (TNC)

- Failing to create a case by the third day after employee started work for pay

- Creating cases for employees hired before E-Verify participant enrollment

Post-Enrollment Activities: Do web services comply with interface control agreements?

Creation of Cases: Is all personally identifiable information safeguarded at all times, with only minimal information retained?

Photo Matching: Are document photos matched to the photo on E-Verify rather than to the employee?

Tentative Nonconfirmation: Do case closure statements notify DHS if an employee who receives a TNC chooses not to contest is not terminated?

DHS & SSA Referral: Do E-Verify participants and employees both sign the English-language version of the referral letter?

Final Case Resolution: Upon receipt of a “DHS No Show” message, does the employee contact DHS within the required time?

Final Case Closure: Does the user file completed Form I-9 and all attachments in a secured location?

Although the self-assessment is a valuable tool to assist employers with E-Verify compliance, the checklists do not render a company audit proof. For assistance implementing best practices for E-Verify and other immigration related topics contact one of our immigration professionals.

Want to stay informed:? Check out our I-9 Employer Resource Center and join our LinkedIn Group

Tags: DHS Referal, E-Verify Case Resolution, E-Verify Direct Access Guide, E-Verify Self-Assessment Guide, E-Verify Web Service Guide, I-9 Form, I-9/E-Verify News, Immigration News, Legal Workforce, Photo Matching, SSA Referral, TNC, USCIS

Posted in I-9/E-Verify News, ICE, Immigration News, USCIS | Comments Off on E-Verify Self-Assessment Guides: A Good Tool but does not render Employer Audit Proof

Tuesday, July 10th, 2012

By: Timothy Sutton, Communications Editor

One of my favorite television shows is Undercover Boss. If you’re unfamiliar with the show, the premise is: a CEO/President takes on a disguise to go undercover within their own business to find ways to (1) become more successful and (2) reward hardworking employees. Obviously, there is an essential element of Hollywood magic that prevents most of us from going “undercover” within our own business; but the lessons learned from this show are no less valuable.

One of my favorite television shows is Undercover Boss. If you’re unfamiliar with the show, the premise is: a CEO/President takes on a disguise to go undercover within their own business to find ways to (1) become more successful and (2) reward hardworking employees. Obviously, there is an essential element of Hollywood magic that prevents most of us from going “undercover” within our own business; but the lessons learned from this show are no less valuable.

Every episode begins with a slightly troubled, but optimistic executive. They instruct their trusted board of directors that they will be resigning from the company to go undercover as an employee over a week’s time in various lower levels of the company, entry-level to management. The goal is to see their business from a fresh perspective. A series of uncomfortable and often illegal encounters ensue where CEOs face discrimination, harassment and even get fired by their own employees. At the end of the hour-long television program, CEOs reward key employees and have “new and improved tools” to develop successful business practices.

There is a better way for your business to experience the same fresh perspective without shaving your head and slapping on a boar’s hair mustache; it’s called an audit. Yes the feared “audit” is most commonly associated with frightful agencies like the IRS and ICE. Yet, Undercover Boss is simply Hollywood’s version of a voluntary audit. In order to become more successful, discovering discrimination, harassment, and wrongful termination within your own business is necessary. The alphabet agencies (ICE, IRS, DOJ, DOL) insist that companies perform annual audits to comply with a multitude of legal formalities. Not only will audits improve business efficiencies and reveal valuable employees, but it will also save your company thousands of dollars for failing a government ICE initiated audit.

The Immigration Compliance Group has years of auditing and consulting experience and a touch of Hollywood magic! Before you invest in your own set of wigs and costumes, contact one of our immigration professionals to discuss I-9 compliance and workforce related issues. Discover how audit prevention and a fresh set of eyes can improve your business. Contact us for support in planning and implementing legally sound solutions to protect your company’s future: 562 612.3996 | info@immigrationcompliancegroup.com.

Link up with us in our group, I-9/E-Verify: Smart Solutions for Employers and stay informed: http://www.linkedin.com/groups?about=&gid=4137860

Tags: Business Solutions, I-9 Audits, I-9 Form, I-9/E-Verify News, ICE Audit, ICE Fines and Penalties, Immigration News, Legal Workforce, Undocumented Workers, WORKSITE COMPLIANCE

Posted in Department Of Homeland Security (DHS), Department Of Labor (DOL), DOJ, I-9/E-Verify News, ICE, Immigration News | Comments Off on Undercover Boss: Preventative Medicine for Businesses | Immigration Compliance Group

Saturday, July 7th, 2012

By: Timothy Sutton, Communications Editor

California’s governor is poised to sign a bill AB 1081 dubbed “The Anti-Arizona Act,” officially titled: Transparency and Responsibility Using State Tools or California TRUST Act. The bill is an attempt by California legislators to set a national precedent: local government opting-out of enforcing federal immigration policies. This anti-Arizona legislation arguably mirrors the purpose of Arizona’s SB 1070, selective enforcement of federal immigration laws. Without question, immigration laws are under federal jurisdiction. Enforcement of immigration law is not within the discretionary powers of a state or local government. The TRUST Act is an attempt by California to allow local government to back out of an agreement with the Immigration and Customs Enforcement (ICE) Secure Communities program signed in 2008.

California’s governor is poised to sign a bill AB 1081 dubbed “The Anti-Arizona Act,” officially titled: Transparency and Responsibility Using State Tools or California TRUST Act. The bill is an attempt by California legislators to set a national precedent: local government opting-out of enforcing federal immigration policies. This anti-Arizona legislation arguably mirrors the purpose of Arizona’s SB 1070, selective enforcement of federal immigration laws. Without question, immigration laws are under federal jurisdiction. Enforcement of immigration law is not within the discretionary powers of a state or local government. The TRUST Act is an attempt by California to allow local government to back out of an agreement with the Immigration and Customs Enforcement (ICE) Secure Communities program signed in 2008.

Secure Communities requires that police and law enforcement provide the federal government with fingerprints of criminal suspects detained by local authorities. These fingerprints are run through a federal database for dangerous undocumented criminals; upon discovery of any prior criminal record, undocumented detainees will be placed into expedited deportation proceedings. California’s initiative to overrule nationally implemented immigration programs is teetering on a slippery slope.

AB 1081 requires:

- Local governments pass “opt-in” ordinances in order to continue participation in the Secure Communities Program

- Submit “anti-racial profiling” plans to the DOJ and monitoring associated with Secure Communities participation

- The modified participation agreement must include safeguards against racial profiling not limited to:

- Prohibiting driver’s license checkpoints to obtain fingerprints

- Establishing an expedited complaint system to review claims prior to removal

Businesses may resent the current administration’s attack on their hiring or employment practices. An unprecedented number of ICE audits, sanctions, civil lawsuits and multi-agency (most recently the SEC) investigations threaten employer’s economic welfare. Nonetheless, allowing states to opt-out of immigration agreements may lead to further complications in the future for American businesses.

While many Americans remain divided on a national Dream Act (deportation stay for undocumented college students), few agree that state enforcement over immigration laws further confuses an already troublesome issue. The solution is to find a nationally supported immigration policy that allows American businesses to thrive, but keeps our borders secure. Critics of AB 1081 believe California will become a “refuge” for undocumented aliens. Currently, our broken immigration system has conflicting policies on employee screening, visa application/renewal, and undocumented criminal deportation. Until the politics of immigration subside, businesses should seek legal assistance to ensure their compliance with ever-changing immigration policies.

Immigration Compliance Group has real-world experience in business and employment-related immigration and compliance matters, ensuring your company’s future is secure. For more breaking immigration news signup to stay informed and contact our office at 562 612.3996 or email info@immigrationcompliancegroup.com.

Tags: AB 1081, California Trust Act, Comprehensive Immigration Reform, Dreamers, Federal Immigraiton Law, ICE, Immigration Legislation, Immigration News, Secure Communities, State and Local Immigration Law, The Anti-Arizona Act

Posted in Comprehensive Immigration Reform, Department Of Homeland Security (DHS), ICE, Immigration Legislation, Immigration News | Comments Off on California Trust Act: AB 1081 | News from Immigration Compliance Group